Buzz of Connections

Exploring the latest trends in dating, relationships, and social interactions.

Finding Gold in the Gloom: Valuations Amid Market Shake-Ups

Uncover hidden treasures in tough markets! Explore savvy valuation strategies that shine even in uncertain times. Dive in now!

Understanding Market Valuations: How to Spot Opportunities During Turmoil

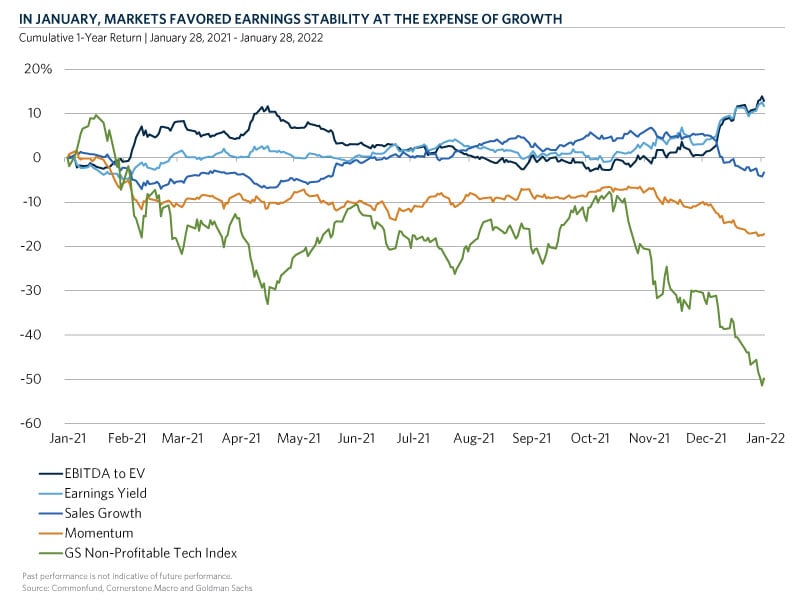

In times of uncertainty, market valuations can become erratic, creating both challenges and opportunities for investors. Understanding the fundamentals of market valuations allows you to identify when stocks or assets are undervalued compared to their intrinsic worth. Utilize key indicators such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield as tools to assess whether a stock is a bargain during market turmoil. Additionally, keep an eye on macroeconomic factors such as interest rates and inflation that can affect overall market sentiment.

To effectively spot these opportunities, it's essential to maintain a disciplined investment approach. Consider implementing a value investing strategy that includes the following steps:

- Conduct thorough research on the companies you’re interested in.

- Analyze their financial health and growth potential.

- Compare current valuations against historical averages.

- Be prepared to hold investments for the long term as the market stabilizes.

Counter-Strike is a highly popular first-person shooter game that has captivated gamers worldwide since its inception. The game features intense team-based gameplay, where players can choose between two sides: terrorists and counter-terrorists. One noteworthy aspect of Counter-Strike is the skin market recovery, which has been a topic of great interest among players as the demand for unique weapon skins continues to evolve.

Navigating Market Volatility: Strategies for Identifying Undervalued Assets

Navigating market volatility can be daunting for investors, but it also presents opportunities to identify undervalued assets. To effectively spot these gems, consider employing a variety of analytical techniques. Begin by conducting fundamental analysis, focusing on key financial metrics such as price-to-earnings (P/E) ratio, debt-to-equity ratio, and earnings growth. This method will help you assess whether a stock's current price does not accurately reflect its intrinsic value. Additionally, utilizing technical analysis can provide insights into price movements and market sentiments, allowing you to time your investments strategically.

Once you have identified potential undervalued assets, it’s crucial to maintain a diversified portfolio to mitigate risk. Here are a few strategies to enhance your investment approach:

- Dollar-Cost Averaging: Invest a fixed amount regularly to avoid market timing issues.

- Value Investing: Look for companies with strong fundamentals that are trading below their true value.

- Stay Informed: Keep an eye on market news and economic indicators that might impact asset values.

By adopting these strategies, investors can confidently navigate the complexities of market volatility while capitalizing on undervalued opportunities.

What to Look for When Assessing Valuations in Uncertain Times

In uncertain times, assessing valuations can be particularly challenging due to fluctuating market conditions and economic instability. It’s essential to look beyond the numbers and evaluate the fundamentals of a business. Key factors to consider include the company's earnings stability, cash flow generation, and overall market position. Additionally, understanding the broader economic landscape, including interest rates and consumer confidence, can provide insights into potential risks. Prioritizing these aspects can lead to more informed valuation assessments.

Another crucial element in valuation during uncertain periods is comparable analysis. Ensure you examine peers within the same industry to benchmark performance and valuation multiples effectively. Consider utilizing techniques such as the Discounted Cash Flow (DCF) method, keeping in mind that projections may need adjustments based on current uncertainties. Lastly, maintaining a flexible mindset and being prepared to revisit valuations regularly can help navigate the challenges of uncertainty and achieve a more accurate picture of value.